Medium Terms Fiscal Plan

for Sikkim

2013-2014 to 2015-2016

To be presented before the Sikkim

Legislative Assembly as required under sub section (1) of section 3

of the Sikkim Fiscal Responsibility and Budget Management Act. 2010

(15 of 2010)

Medium Term Fiscal Plan for

Sikkim: 2013-14

1. Introduction – Fiscal

Policy Overview

The State of Sikkim

has made remarkable progress in achieving socio-economic development

in 11th Plan period and aims at broad based and sustainable growth

process during the 12th Plan period. The fiscal policy adopted by the

State Government over the years and as reflected in this year’s

budget, endeavors to provide an enabling environment for economic

development and achievement of social sector commitments.

The Gross State Domestic Product (GSDP) at constant prices recorded a

growth rate of 8.16 per cent in 2011-12. The per capita income of the

state, which was Rs.30727 in 2004-05, has increased substantially to

Rs.136362 in 2011-12 at current prices[1]. The major socio-economic

indicators for the State show commendable improvement. The poverty

ratio has declined to 13.1 per cent as compared to all India average

of 29.8 per cent. While the literacy rate has increased to 82.2 per

cent, the IMR has gone down to 26 per 1000. The economic development

has helped the State Government to pursue its development agenda. The

State has been emerging from the devastating earthquake of 2011 and

the rebuilding and reconstruction activities are still going on.

The Fiscal Responsibility and Budget Management

Act (FRBM) adopted in the fiscal year 2010-11 continues to provide a

benchmark for fiscal management in terms of budget decisions and

achievements of prescribed fiscal targets. The Act requires the State

Government to present a Medium Terms Fiscal Policy (MTFP) to reflect

on fiscal policy choices made by the Government in the ensuing budget

year and the fiscal stance of the Government in two future years

beyond the budget year in a transparent manner. This is the third

MTFP. The FRBM Act was enacted with the objective of managing the

fiscal policy that ensures stability and sustainability. A

sustainable fiscal management improves the credibility of the

Government and ensures provision of required level of physical and

social infrastructure. Adequate social and physical infrastructure

helps providing an enabling environment for investments which would

create employment and incomes for the people of the state.

The fiscal adjustment path for Sikkim recommended by the

Thirteenth Finance Commission (TFC) with targeted fiscal deficit to

ensure sustainable level of debt ends at 2014-15. The MTFP however

includes projections till 2015-16. The last year of the MTFP will

come under the award period of the 14th Finance Commission, which has

already been constituted. The ensuing budget for the year 2013-14 and

MTFP for next two outward years continue to adhere to the

quantitative fiscal targets with regard to deficits and debt level as

enunciated by the TFC. The prudent fiscal management of the State was

recognised by the TFC and it recommended performance incentive grant

for Sikkim along with various state specific grants. While the TFC

grants have been put to use in the specified sectors, there are many

other sectors in which the State requires generous grants from the

Fourteenth Finance Commission. Indeed the State faces considerable

cost disabilities in service provisions and any innovative programme

requires contribution from the Central Government.

The MTFP 2013-14 presents the fiscal policy

stance of the Government and projected fiscal targets in the ensuing

budget year and two outward years. It reviews the macroeconomic and

fiscal performance of Sikkim for the period from 2004-05 to 2013-14.

The assumptions with regard to the revenue augmentation and

expenditure restructuring parameters for the preparation of the MTFP

are arrived at on the basis of the data covering the period from

2004-05 to 2013-14 (BE) and taking into consideration the policy

announcements relating to revenue augmentation measures and

expenditure priorities in various sectors.

The rest of the report is organized as follows.

The Section 2 provides an analysis of the recent macroeconomic

achievements. The fiscal policy overview, tax, expenditure, and

borrowing policies for the ensuing year and the priorities in the

medium term are presented in Section 3. This section follows

the Form F-1 of the Medium Term Fiscal Policy as per the Sikkim FRBM

Act, Rule 3. In Section 4, Medium Term Fiscal Plan containing

the projection of fiscal variables and assumptions underlying the

projections has been given. This follows the Form F 2 of Sikkim FRBM

Act, Rule 3. The concluding remarks are contained in section 5. The

disclosures, following the Medium Term Fiscal Policy as per the

Sikkim FRBM Act Rule 3 and Rule 4, are given in the Section called

Disclosures.

2. Macroeconomic Outlook

The macroeconomic performance and the outlook for the medium term

influence the preparation of MTFP. The State economy is assumed to

provide a base for the revenue and any projection for the future

years has to be related to the growth performance of the State. The

state level fiscal policy assumes key role in the development of

different sectors and macroeconomic performance. While the Sikkimese

economy was evolving as a service sector driven economy, since

2009-10 the relative share of secondary sector has increased mostly

driven by manufacturing, construction and power sectors. The

inter-sectoral composition of GSDP since 2004-05 shows that the

service sector, which accounted for half of the State GSDP till

2008-09, has declined to about 38 per cent in 2011-12. At the same

time the relative share of the secondary sector has grown to about 54

per cent in 2011-12 (Table 1). The share of primary sector has been

declining over the years and the share of mining and quarrying

activities remained very small.

Table 1

Composition of GSDP (Constant

Prices)

(Per cent)

|

|

2004-05

|

2005-06

|

2006-07

|

2007-08

|

2008-09

|

2009-10

|

2010-11

|

2011-12

|

|

Primary, of Which

|

18.71

|

17.74

|

16.76

|

16.18

|

14.56

|

8.74

|

8.32

|

8.04

|

|

Agriculture

|

18.59

|

17.63

|

16.65

|

16.07

|

14.40

|

8.65

|

8.22

|

7.94

|

|

Mining & Quarrying

|

0.12

|

0.11

|

0.11

|

0.11

|

0.15

|

0.10

|

0.10

|

0.10

|

|

Secondary, of which

|

28.72

|

29.25

|

29.54

|

30.18

|

34.94

|

55.03

|

54.67

|

54.16

|

|

Manufacturing

|

3.86

|

3.60

|

3.66

|

3.90

|

3.65

|

28.44

|

26.88

|

25.84

|

|

Construction

|

19.23

|

19.86

|

19.44

|

18.69

|

15.52

|

9.91

|

10.26

|

10.68

|

|

Electricity & Water supply

|

5.62

|

5.78

|

6.44

|

7.59

|

15.76

|

16.69

|

17.54

|

17.64

|

|

Tertiary, of Which

|

52.58

|

53.01

|

53.70

|

53.64

|

50.51

|

36.22

|

37.01

|

37.80

|

|

Transport

|

2.69

|

2.63

|

2.59

|

2.48

|

2.26

|

1.61

|

1.60

|

1.59

|

|

Trade, Hotel and Restaurant

|

5.19

|

4.84

|

4.62

|

4.51

|

4.07

|

2.43

|

2.30

|

2.22

|

|

Banking & Insurance

|

2.58

|

2.95

|

3.59

|

4.04

|

3.64

|

2.60

|

3.12

|

3.74

|

|

Real Estate

|

9.99

|

9.38

|

9.19

|

9.94

|

9.49

|

5.60

|

5.46

|

5.32

|

|

Public Admn

|

14.60

|

15.14

|

15.52

|

14.79

|

14.15

|

11.72

|

11.56

|

11.53

|

|

Other Services

|

16.09

|

16.52

|

16.41

|

15.81

|

14.70

|

10.93

|

11.45

|

11.57

|

|

GSDP Growth Rate

|

|

8.45

|

4.53

|

6.53

|

14.81

|

71.59

|

6.90

|

6.93

|

Source: State Income Unit, DESM&E, Government of Sikkim

.

The impressive growth of GSDP in recent years was due to the

contributions from power and manufacturing sectors. The Planning

Commission (State Plan Division) while analyzing the growth process

of the State during the Eleventh Plan indicated that commissioning of

power projects, strengthening of small scale industries and

pharmaceutical industries helped the growth process. The MTFP

projection, however, is based on the growth path prescribed by the

TFC for Sikkim. TFC has assumed a nominal growth rate of 11.25 per

cent for Sikkim during the period 2012-13 to 2014-15.

3. Fiscal Profile of the State

3.1 Fiscal Policy Overview

The fiscal trend since 2004-05 presented in Table 4

shows that there has been considerable improvement in the fiscal

situation in recent years. The State has been maintaining surplus in

the revenue account and the fiscal deficit has been reduced to the

level prescribed by the TFC. The introduction of FRBM Act in 2010-11

provided the rule based fiscal management with defined deficit and

debt targets. The post FRBM experience indicates considerable

improvement in fiscal situation and containment of fiscal deficit and

rise in revenue surplus. The surplus in the revenue account which was

at 11.7 per cent to GSDP in 2008-09, increased to 12.9 per cent in

2012-13 revised estimates. The budget estimates for 2013-14 assumes a

revenue account surplus of 9.7 per cent to GSDP. The fiscal deficit

was reduced considerably from 7.2 per cent relative to GSDP in

2008-09 to about 2 per cent in 2011-12 and is projected to remain

limited to 3 per cent in the budget estimates for the year 2013-14.

The fiscal consolidation will be instrumental for growth in the

future years by creating fiscal space for the State Government to

allocate resources to the priority areas. The MTFP projects to

maintain the fiscal consolidation process in the two outward years

and improve resource availability to social and economic sectors.

The fiscal trend indicates that the State

Government complied with the TFC recommendations and its own FRBM

targets. The TFC in their fiscal consolidation path for Sikkim has

targeted the fiscal deficit to decline and recommended it to be at

the level of 3.5 per cent to GSDP in 2011-12 and 2012-13 and further

reduce to 3 per cent in 2013-14 and 2014-15. The State FRBM act,

enacted in 2010-11, stipulates to reduce the fiscal deficit to 3 per

cent of GSDP by 2013-14. The MTFP 2013-14 builds on the strong

fiscal performance of the State Government and complies with TFC

proposed path of fiscal consolidation.

Table 2

Fiscal Profile of Sikkim: An Overview

(% to GSDP)

|

|

2004-05

|

2005-06

|

2006-07

|

2007-08

|

2008-09

|

2009-10

|

2010-11

|

2011-12

|

2012-13 (RE)

|

2013-14 (BE)

|

|

Revenues

|

58.1

|

54.6

|

55.7

|

59.8

|

54.4

|

38.2

|

30.1

|

34.2

|

43.5

|

41.0

|

|

Own Revenue

|

13.1

|

13.1

|

16.0

|

16.4

|

15.2

|

10.9

|

7.3

|

6.4

|

7.1

|

7.2

|

|

Own Tax Revenues

|

6.7

|

7.4

|

8.0

|

7.9

|

6.2

|

3.6

|

3.9

|

3.5

|

4.0

|

4.1

|

|

Own Non-Tax Revenues

|

6.4

|

5.7

|

7.9

|

8.5

|

9.1

|

7.3

|

3.4

|

2.9

|

3.2

|

3.1

|

|

Central Transfers

|

45.0

|

41.5

|

39.7

|

43.4

|

39.2

|

27.3

|

22.8

|

27.8

|

36.4

|

33.8

|

|

Tax Devolution

|

6.2

|

9.1

|

10.3

|

13.8

|

11.3

|

6.1

|

7.3

|

7.3

|

7.5

|

8.0

|

|

Grants

|

38.8

|

32.4

|

29.4

|

29.6

|

28.0

|

21.2

|

15.5

|

20.5

|

28.9

|

25.8

|

|

Revenue Expenditure

|

48.4

|

44.7

|

45.1

|

45.8

|

42.8

|

29.8

|

28.2

|

28.9

|

30.6

|

31.2

|

|

Interest Payment

|

5.7

|

5.1

|

5.3

|

4.7

|

4.8

|

2.5

|

2.6

|

2.3

|

2.2

|

2.0

|

|

Pension

|

1.8

|

2.1

|

2.3

|

2.0

|

1.8

|

2.1

|

2.2

|

2.1

|

2.6

|

2.7

|

|

Capital Expenditure

|

20.4

|

17.3

|

15.1

|

16.6

|

18.9

|

11.2

|

6.4

|

7.9

|

16.1

|

12.7

|

|

Capital Outlay

|

20.3

|

17.3

|

15.1

|

16.6

|

18.9

|

10.6

|

6.3

|

7.3

|

16.0

|

12.6

|

|

Net Lending

|

0.1

|

0.0

|

0.0

|

0.0

|

0.0

|

0.6

|

0.1

|

0.6

|

0.0

|

0.1

|

|

Revenue Deficit

|

-9.7

|

-9.9

|

-10.6

|

-14.0

|

-11.7

|

-8.4

|

-2.0

|

-5.3

|

-12.9

|

-9.7

|

|

Fiscal Deficit

|

10.7

|

7.5

|

4.5

|

2.6

|

7.2

|

2.8

|

4.4

|

2.1

|

3.2

|

3.0

|

|

Primary Deficit

|

5.0

|

2.3

|

-0.9

|

-2.1

|

2.5

|

0.2

|

1.8

|

-0.1

|

1.1

|

1.0

|

|

Outstanding Debt

|

61.9

|

60.3

|

61.2

|

62.3

|

59.9

|

37.4

|

34.0

|

30.4

|

29.9

|

29.9

|

Source (Basic Data): Finance Accounts and State

Budget 2013-14

Note: The GSDP figures are from State Income Unit,

DESM&E, Government of Sikkim .

Negative sign indicates revenue surplus

3.2 Revenue Mobilisation

The central transfers that include share in

central taxes and grants constitute the major source of revenue for

the State Government. On an average the central transfers constitutes

little more than there fourths of the total State revenues. The

central transfer, which constituted 39.2 per cent in 2008-09 relative

to GSDP, has come down to 36.4 per cent in the revised estimates of

2012-13 and is budgeted at 33.8 per cent in 2013-14. Own tax and own

non–tax revenue are expected to be 4.1 and 3.1 (net of lottery

expenditure) per cent of GSDP respectively as per the BE of 2013-14.

From Table 2 it is evident that the own revenue and GSDP ratio

has declined substantially since 2008-09. While the growth of state

taxes remained healthy, the ratio with GSDP has declined due to very

high increase in GSDP since 2009-10. The generation of electricity by

newly commissioned power projects and growth of chemical and

pharmaceutical industries have contributed heavily to the growth of

GSDP and the State taxes have not kept pace with the GSDP growth.

A disaggregated analysis of revenue performance of the state is

undertaken to determine the revenue prospects while preparing the

MTFP aligned with the provisions of FRBM act of Sikkim.

Composition of own tax revenue is given in Table

3. The sales tax/VAT and State excise are two major sources of

own tax revenue for the State. The relative share of the VAT was at

42.3 per cent in 2011-12, the last year for which audited figures are

available. It is set to rise to 55 and 53 per cent respectively in

2012-13 (RE) and 2013-14 (BE). The relative share of State

excise in total own revenue has remained at about 25 per cent leaving

the year 2011-12 when its share jumped to 32.8 per cent. During the

same time period the motor vehicle tax has evolved as one of the

major state taxes. The trend growth rates of individual tax

components explain the change in tax structure in the state.

The sales tax, state excise and motor vehicle tax have shown high

growth rates during this period.

Table 3

Composition of Own Tax Revenue

(Per cent)

|

|

2004-05

|

2005-06

|

2006-07

|

2007-08

|

2008-09

|

2009-10

|

2010-11

|

2011-12

|

2012-13 (RE)

|

2013-14 (BE)

|

Growth (04-05 to 13-14)

|

|

Own Tax Revenues

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

14.2

|

|

Sales Tax

|

41.2

|

38.5

|

43.1

|

41.1

|

50.8

|

54.1

|

51.1

|

42.3

|

55.1

|

52.9

|

18.0

|

|

State Excise Duties

|

28.0

|

22.4

|

19.2

|

19.2

|

23.3

|

25.6

|

25.3

|

32.8

|

25.7

|

25.6

|

16.8

|

|

Motor Vehicle Tax

|

2.8

|

2.9

|

3.4

|

3.1

|

3.5

|

3.5

|

3.8

|

5.6

|

4.1

|

3.9

|

20.3

|

|

Stamp Duty and Registration Fees

|

1.2

|

1.5

|

1.5

|

2.2

|

2.2

|

2.0

|

2.0

|

2.8

|

2.0

|

1.9

|

20.3

|

|

Other Taxes

|

2.0

|

2.2

|

5.9

|

10.0

|

12.9

|

14.4

|

17.6

|

16.5

|

13.2

|

15.7

|

43.8

|

The buoyancy coefficients for the State taxes during

the period 2004-05 to 2013-14 given in Table 4 reveal that the growth

of taxes has fallen behind the growth of the GSDP. The buoyancy

coefficient explains the percentage growth in tax revenue in response

to one percentage growth in GSDP. This relationship assumes that the

State GSDP is the proxy for tax base. The pattern of growth in

the State suggests that the sectors growing rapidly and contributing

to growth process have not contributed to tax revenues. Particularly

the generation of electricity by the hydro-electric sector though

contribute to the growth numbers, their effects are yet to be felt in

terms rise in business and trade activities in the State. The growth

process is expected to provide impetus to rise in trade and business

activities and thus higher tax collection in the future years. The

MTFP after calibrating the growth potential of the GSDP and other tax

measures announced in BE 2013-14 makes suitable adjustment in tax

buoyancies for projection of tax revenues in the medium term.

Table 4

Buoyancy of Taxes: 2004-05 to 2012-13

|

Own Tax Revenues

|

0.546

|

|

Sales Tax

|

0.687

|

|

State Excise Duties

|

0.672

|

|

Motor Vehicle Tax

|

0.773

|

|

Stamp Duty and Registration Fees

|

0.763

|

|

Other Taxes

|

1.501

|

Source (Basic Data): Finance Accounts and State

Budget 2012-13

The own non-tax revenue remains an important

source of revenue for the State as it constitutes about half of the

own revenue receipts. Income from State lottery, power sector, road

transport, and interest receipts has been the main source of non-tax

revenue (Table 5). The relative share of lottery income (net)

shows volatility in terms of its contribution to the own non-tax

revenue and set to decline from 17.8 per cent in 2011-12 to 12.6 per

cent in 2013-14 (BE). The Government initiatives like broad basing

the lottery operations with the introduction of the on-line

lotteries, and introduction of on-line casino operations with the

passage of Sikkim Casino Games (Control & Tax) Act 2002 are

expected to yield increasing revenue from lottery operations. The

relative share of income from power sector has increased in recent

years showing a peak of 64. 2 per cent in 2009-10 as the newly

commissioned hydro-project units started giving the State share in

the production of electricity. Although the relative share of power

sector has gradually declined from 2009-10 high, it still remains

large at 34.6 per cent in 2013-14 (BE). The hydro power projects

being constructed in the State are expected to make significant

contribution in the coming years also. The Government had

rationalized the power tariff by raising it by 16 % in 2012-13, which

helped in improving the income from this source. The share of road

transport in own non-tax revenue has been growing over the years. The

income from forestry and wild life, though declined in between, seems

to have been recovering in the recent years.

Table 5

Composition of States’ Own Non-tax Revenues

(Per Cent)

|

|

2004-05

|

2005-06

|

2006-07

|

2007-08

|

2008-09

|

2009-10

|

2010-11

|

2011-12

|

2012-13 (RE)

|

2013-14 (BE)

|

|

Own Non-Tax Revenue

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

|

Interest Receipts

|

7.2

|

5.5

|

3.1

|

7.1

|

8.9

|

9.9

|

7.2

|

12.0

|

7.2

|

9.1

|

|

Dividends and Profits

|

0.8

|

1.0

|

0.4

|

0.3

|

0.4

|

0.1

|

0.8

|

0.0

|

0.1

|

0.3

|

|

Police

|

3.9

|

12.4

|

8.1

|

6.9

|

4.0

|

3.3

|

9.9

|

5.3

|

15.2

|

15.8

|

|

Public Works

|

2.2

|

2.7

|

2.2

|

2.0

|

1.7

|

0.6

|

1.6

|

2.2

|

1.4

|

1.4

|

|

Administrative Services

|

3.4

|

2.6

|

1.5

|

1.2

|

0.9

|

1.0

|

1.4

|

2.7

|

1.3

|

1.3

|

|

Net Lottery Income

|

28.0

|

19.5

|

29.1

|

14.5

|

15.0

|

9.2

|

16.4

|

17.8

|

16.9

|

12.6

|

|

Edu, Sports, Art & Cult.

|

0.7

|

0.8

|

0.6

|

0.6

|

0.6

|

0.4

|

0.6

|

0.6

|

0.4

|

0.5

|

|

Medical and Pub. Health

|

0.9

|

0.8

|

0.3

|

0.5

|

0.3

|

0.2

|

0.2

|

0.5

|

0.4

|

0.4

|

|

Water Sup. and Sanitation

|

1.0

|

1.0

|

1.2

|

1.0

|

0.9

|

0.6

|

1.2

|

1.2

|

1.2

|

1.2

|

|

Urban Development

|

0.8

|

0.6

|

0.4

|

0.6

|

0.5

|

0.7

|

0.3

|

0.7

|

0.3

|

0.2

|

|

Forestry and Wildlife

|

7.1

|

8.8

|

5.5

|

5.2

|

3.9

|

2.0

|

4.5

|

5.1

|

4.6

|

4.8

|

|

Plantations

|

1.5

|

1.8

|

1.1

|

1.0

|

0.8

|

0.4

|

1.1

|

1.1

|

1.1

|

1.1

|

|

Other Rural Dev. Prog.

|

0.7

|

1.1

|

0.6

|

0.5

|

0.4

|

0.6

|

0.5

|

0.5

|

0.4

|

0.5

|

|

Power

|

19.2

|

24.6

|

33.9

|

46.1

|

52.9

|

64.2

|

40.9

|

32.7

|

33.9

|

34.6

|

|

Road Transport

|

19.3

|

12.0

|

8.6

|

7.4

|

6.0

|

4.6

|

9.3

|

12.7

|

10.8

|

11.3

|

|

Tourism

|

0.7

|

0.7

|

0.5

|

0.6

|

0.7

|

0.4

|

1.3

|

0.8

|

1.7

|

1.8

|

|

Others

|

2.6

|

4.1

|

2.7

|

4.6

|

1.9

|

2.0

|

2.8

|

4.2

|

3.1

|

3.2

|

Source (Basic Data): Finance Accounts and State

Budget 2013-14

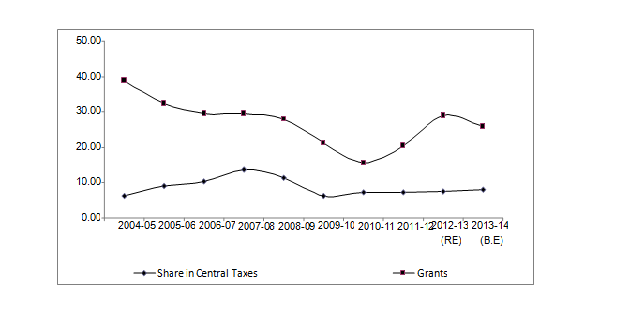

Central Transfers as Percentage of GSDP

From the Figure 1 it is evident that the share

in central taxes remained at about 8 per cent of GSDP in recent

years. Comparatively the Central grants contribute more to the State

revenues. The Central grant to the State was further widened due to

the recommendations of the TFC relative to various state specific

grants and performance incentive grant. Starting from 2011-12, the

State has been receiving State specific grants recommended by the TFC

such as development of tourism, innovation of suspension foot

bridges under North Districts of Sikkim, water security and public

health engineering, police training and infrastructure, residential

facility for police, border area development, State Capacity Building

Institute, and conservation of heritage and culture. These grants, to

be continued till 2014-15, have contributed substantially to the

overall revenues of the State and facilitated building infrastructure

in the sectors for which grants are targeted. The State has

also received performance incentive grant for three years from

2010-11 to 2012-13. The State continues to get TFC grants for

elementary education, environment related grants including forest,

and water sector management, incentive grants to improve quality of

public expenditure starting from 2010-11 to 2014-15. The grants for

maintenance of roads and bridges, however, started in the year

2011-12.

3.3 Expenditure Profile

The social sector, particularly education and

health in Sikkim, receive special attention in the resource

allocation. In order to improve the quality of education and health

infrastructure, the State Government has initiated several measures.

The expenditure pattern presented in Table 6 reflects these trends

over the years. Due to spurt in growth of GSDP in 2009-10, the ratio

of expenditure variables with GSDP declined. Thus the expenditure

pattern since 2009-10 will be of interest in the context of the MTFP.

The revenue expenditure, which had declined from 29.8 per cent

relative to GSDP in 2009-10 to 28.9 per cent in 2011-12, is set to

rise in revised estimates for the year 2012-13 and budget estimates

for the year 2013-14. The revenue expenditure is projected to reach

at 31.2 per cent to the GSDP in 2013-14 (BE). The revenue expenditure

profile shows that while the general service remained flat relative

to GSDP, the expenditure on economic and social services have

increased during 2009-10 and 2013-14 (BE). The MTFP elaborates on the

expenditure restructuring in the medium term where emphasis has been

given to priority sector development spending.

Table 6

Expenditure Profile

(Per cent to GSDP)

|

|

2004-05

|

2005-06

|

2006-07

|

2007-08

|

2008-09

|

2009-10

|

2010-11

|

2011-12

|

2012-13 (RE)

|

2013-14 (BE)

|

|

Revenue Expenditure

|

48.4

|

44.7

|

45.1

|

45.8

|

42.8

|

29.8

|

28.2

|

28.9

|

30.6

|

31.2

|

|

General Services

|

14.9

|

14.4

|

15.5

|

15.5

|

13.8

|

10.7

|

9.6

|

9.0

|

10.0

|

10.4

|

|

Interest Payment

|

5.7

|

5.1

|

5.3

|

4.7

|

4.8

|

2.5

|

2.6

|

2.3

|

2.2

|

2.0

|

|

Pension

|

1.8

|

2.1

|

2.3

|

2.0

|

1.8

|

2.1

|

2.2

|

2.1

|

2.6

|

2.7

|

|

Other General Services Excluding Salary

|

7.4

|

7.2

|

7.9

|

8.8

|

7.2

|

6.2

|

4.7

|

4.6

|

5.2

|

5.7

|

|

Social Services

|

17.6

|

16.9

|

16.5

|

17.5

|

16.7

|

11.3

|

11.4

|

12.3

|

11.4

|

12.1

|

|

Education

|

8.8

|

9.4

|

9.3

|

9.1

|

8.4

|

6.4

|

7.6

|

5.6

|

5.7

|

6.0

|

|

Medical and Public Health

|

2.8

|

2.3

|

2.3

|

2.6

|

2.3

|

1.8

|

1.5

|

1.4

|

1.3

|

1.3

|

|

Other Social Services

|

6.0

|

5.2

|

4.9

|

5.8

|

6.0

|

3.1

|

2.4

|

5.3

|

4.4

|

4.9

|

|

Economic Services

|

15.9

|

13.4

|

13.1

|

12.8

|

12.2

|

7.8

|

7.0

|

7.3

|

8.7

|

8.2

|

|

Compensation and Assignment to LBs

|

0.0

|

0.0

|

0.0

|

0.0

|

0.0

|

0.0

|

0.2

|

0.4

|

0.5

|

0.5

|

|

Capital Expenditure

|

20.4

|

17.3

|

15.1

|

16.6

|

18.9

|

11.2

|

6.4

|

7.9

|

16.1

|

12.7

|

|

Capital Outlay

|

20.3

|

17.3

|

15.1

|

16.6

|

18.9

|

10.6

|

6.3

|

7.3

|

16.0

|

12.6

|

|

Net Lending

|

0.1

|

0.0

|

0.0

|

0.0

|

0.0

|

0.6

|

0.1

|

0.6

|

0.0

|

0.1

|

Source (Basic Data): Finance Accounts and State

Budget 2013-14

The capital expenditure, which had slowed down in

2010-11 and 2011-12 relative to the GSDP, seems to have revived in

2012-13 (RE) and 2013-14 (BE). The requirements for achieving

sustainable level of debt and deficit as stipulated in the FRBM

fiscal targets required limiting the level of capital expenditure.

The capital expenditure, however, has increased from 7.9 per cent to

GSDP in 2011-12 to 16.1 per cent in 2012-13 (RE) and the budget

estimates for 2013-14 sets a target of 12.7 per cent (Table 6). The

composition of capital expenditure shows that sectors like water

supply and sanitation, transport, energy and tourism have been the

focus areas. The education and rural development sectors also have

attracted relatively higher capital expenditure. The improvement in

fiscal situation in the State provides opportunity to reinforce the

core development strategy of building the social and physical

infrastructure. The MTFP is prepared based on the rationale of

restructuring the government spending by emphasizing the critical

areas.

Table 7

Composition of Capital Expenditure

(Per Cent)

|

|

2004-05

|

2005-06

|

2006-07

|

2007-08

|

2008-09

|

2009-10

|

2010-11

|

2011-12

|

2012-13 (RE)

|

2013-14 (BE)

|

|

Capital Expenditure

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

|

General Services

|

4.7

|

5.0

|

6.5

|

9.5

|

12.6

|

13.7

|

12.6

|

4.1

|

12.6

|

15.5

|

|

Social Services

|

37.2

|

31.5

|

36.6

|

32.6

|

31.1

|

34.0

|

36.8

|

45.0

|

40.1

|

36.2

|

|

Education

|

8.3

|

7.2

|

7.7

|

4.7

|

4.8

|

4.2

|

8.7

|

10.2

|

5.9

|

5.7

|

|

Health

|

1.0

|

2.3

|

0.6

|

0.6

|

1.1

|

0.5

|

7.1

|

15.8

|

7.3

|

8.2

|

|

Water supply, Sanitation, Housing & Urban

Development

|

27.4

|

22.0

|

27.2

|

25.6

|

24.7

|

27.9

|

20.5

|

18.5

|

26.4

|

21.1

|

|

Information, Publicity & Broadcasting (21)

|

0.0

|

0.0

|

0.0

|

0.0

|

0.0

|

0.2

|

0.2

|

0.2

|

0.1

|

0.0

|

|

Welfare of SC/STBC

|

0.3

|

0.0

|

0.9

|

0.3

|

0.5

|

0.2

|

0.1

|

0.2

|

0.5

|

0.4

|

|

Social Security

|

0.2

|

0.0

|

0.1

|

1.3

|

0.1

|

0.9

|

0.1

|

0.0

|

0.0

|

0.7

|

|

Economic Services

|

58.1

|

63.5

|

57.0

|

58.0

|

56.2

|

52.3

|

50.7

|

50.9

|

47.2

|

48.3

|

|

Agriculture

|

1.1

|

1.5

|

1.8

|

1.7

|

1.5

|

2.3

|

1.4

|

2.8

|

1.8

|

1.4

|

|

Rural Development

|

3.3

|

1.9

|

7.7

|

9.2

|

4.0

|

5.2

|

5.0

|

5.8

|

1.6

|

2.1

|

|

Special Areas Programmes

|

0.9

|

7.2

|

8.0

|

5.5

|

1.7

|

1.8

|

2.5

|

2.9

|

1.8

|

1.4

|

|

Irrigation

|

0.7

|

0.6

|

0.8

|

0.7

|

0.8

|

0.5

|

1.2

|

0.5

|

0.7

|

0.4

|

|

Energy

|

28.2

|

25.5

|

11.7

|

11.4

|

10.1

|

11.1

|

7.3

|

6.1

|

7.0

|

3.5

|

|

Industries and Minerals

|

1.9

|

2.3

|

1.1

|

0.6

|

1.1

|

0.8

|

0.4

|

0.3

|

0.4

|

0.4

|

|

Transport

|

20.3

|

20.7

|

19.1

|

20.4

|

29.1

|

22.8

|

21.8

|

23.1

|

23.5

|

26.8

|

|

Science & Technology

|

0.0

|

0.0

|

0.1

|

0.4

|

0.3

|

0.2

|

0.0

|

0.0

|

0.0

|

0.0

|

|

Tourism

|

1.7

|

3.9

|

6.7

|

8.0

|

7.6

|

7.6

|

11.0

|

9.3

|

10.5

|

12.3

|

Source (Basic Data): Finance Accounts and State

Budget 2012-13

3.4 Outstanding Debt and Government Guarantee

Outstanding debt of the Government of Sikkim

has declined from 37.4 per cent in 2009-10 to 30.4 per cent in

2011-12, the last year for which audited data is available (Table 2).

The outstanding debt is estimated to fall further in RE 2012-13 and

BE 2013-14. The FRBM Act of the state stipulates to maintain the

outstanding debt at prudent and sustainable level. With the

improvement in fiscal situation in the State, the debt burden has

been slowing down. The TFC in their revised fiscal roadmap have

worked out the yearly outstanding debt burden for all the states

aligning with the fiscal path. The outstanding debt burden of Sikkim

for the years 2013-14 and 2014-15 as per the TFC fiscal roadmap is

58.80 and 55.90 relative to the GSDP respectively. The debt-GSDP

ratio in the State remains lower than that of the TFC numbers. The

decline in the average cost of debt of the state as a result of the

debt restructuring formula of the Twelfth Finance Commission has

helped to lowering the debt burden. Decline in the average cost of

debt will result in higher fiscal space for the state government

through reduction in the volume of interest payments, which has

declined from 2.5 per cent in 2009-10 relative to GSDP to 2 per cent

in 2013-14 (BE).

Table 8

Composition of Debt and Liabilities

(Per Cent)

|

|

2008-09

|

2009-10

|

2010-11

|

2011-12

|

2012-13 (RE)

|

|

A. Public Debt

|

76.87

|

78.15

|

74.63

|

72.56

|

72.47

|

|

Internal Debt

|

61.34

|

65.86

|

63.94

|

66.41

|

66.71

|

|

Loans and Adv. from the Central Govt.

|

15.53

|

12.28

|

10.69

|

6.15

|

5.76

|

|

B. Other Liabilities

|

23.13

|

21.85

|

25.37

|

27.44

|

27.53

|

|

Small Savings, Provident Fund etc

|

18.94

|

17.96

|

21.00

|

22.67

|

23.82

|

|

Reserve Fund

|

1.32

|

1.04

|

0.85

|

0.72

|

0.02

|

|

Deposits

|

2.87

|

2.85

|

3.51

|

4.05

|

3.70

|

|

Total Public Debt & Other Liabilities

|

100

|

100

|

100

|

100

|

100.00

|

Source (Basic Data): Finance Accounts and State

Budget 2013-14

The accumulated stock of debt is the outcome of the

fiscal profile that has emerged over the years. The structure

of outstanding debt has an important bearing on interest payment as

different debt instruments carry different rates of interest

depending on the type of borrowing and maturity structure. The share

of market borrowing in the state has increased over the years while

the share of loans and advances from the Central government has

declined in the last two years (Table 8). The share of high cost debt

instruments like small savings, provident funds, etc. has shown a

rising trend since 2008-09.

The Planning Commission of India has indicated

six parameters to determine the quality of debt stock of any State.

1.

The Debt Stock should be below 30 per cent

of the GSDP.

2.

Debt should be below 300 per cent of the

Total Revenue Receipts (TRR).

3.

The interest payment should be less than 18

per cent as a ratio of TRR.

4.

The debt growth should not be more than

1.25 times the growth in revenues.

5.

The revenue component of the fiscal deficit

should not be more than 50 per cent.

6.

The fiscal deficit should not be more than

25 per cent of the TRR.

The degree of debt overhang for Sikkim as

examined taking into consideration these criteria is given in Table

9. The debt ratio remained above 30 per cent of GSDP till

2011-12 and has come down after that. The debt as a percentage of TRR

remained much below 300 per cent and declining sharply in recent

years and was as low as 68.8 per cent in 2012-13 (RE). The interest

payment as a percentage of TRR remained below 18 per cent as

indicated in the Planning Commission parameters. The state government

could generate a revenue surplus and the ratio of debt growth to

revenue growth is below the permissible target of 1.25. The

state’s fiscal deficit remained below 25 per cent of the TRR.

Table 9

Indicators of Debt Management

(Per Cent)

|

|

2009-10

|

2010-11

|

2011-12

|

2012-13 (RE)

|

|

Debt Stock as per cent of GSDP*

|

37.4

|

34.0

|

30.4

|

29.9

|

|

Debt as a per cent of TRR

|

97.8

|

112.9

|

88.9

|

68.8

|

|

Interest payment as a per cent of TRR

|

6.6

|

8.7

|

6.6

|

5.0

|

|

Growth rate of debt

|

18.6

|

6.0

|

5.1

|

9.5

|

|

Growth rate of revenue

|

33.4

|

-8.3

|

33.5

|

41.5

|

|

Ratio debt growth-revenue growth

|

0.6

|

-0.7

|

0.2

|

0.2

|

|

FD as a per cent of TRR

|

7.2

|

14.7

|

6.3

|

7.4

|

Note: This represents the aggregate debt liabilities

of the State

Guarantees given by the State Government

As per the Sikkim Government Guarantee Act, 2000,

the ceiling on total outstanding government guarantee in a year is

restricted to three times of the State’s tax revenue receipts

of the second preceding year. The outstanding sum guaranteed by the

State government on 31st

March 2013 was Rs.310. crore (Budget Documents – 2013-14),

which is below the permissible limit.

4. Medium Term Fiscal Plan: 2013-14 to 2015-16

4.1 Fiscal Indicators

Table 10 (follows

Form F2 of the Act)

Fiscal Indicators-Rolling Targets

|

|

|

Previous Year (Y-2) Actuals

|

Current Year (Y-1) Revised Estimates

|

Ensuing Year (Y)

Budget Estimates

|

Targets for Year (Y+1

|

Targets for Year Y+2)

|

|

|

|

2011-12

|

2012-13 (RE)

|

2013-14 (BE)

|

2014-15

|

2015-16

|

|

1

|

Revenue deficit as percentage of GSDP

|

-5.27

|

-12.85

|

-9.74

|

-10.50

|

-11.34

|

|

2

|

Revenue deficit as percentage of Total Revenue

Receipts (TRR)

|

-15.41

|

-29.55

|

-23.77

|

-24.13

|

-24.53

|

|

3

|

Fiscal deficit as percentage to GSDP

|

2.14

|

3.24

|

3.00

|

3.00

|

3.00

|

|

4

|

Total Outstanding Liabilities as percentage of

GSDP

|

30.39

|

29.92

|

29.90

|

29.87

|

29.85

|

Notes:

GSDP is the Gross Domestic Product at

current prices as per revised series of 2004-05 base

The negative sign in revenue deficit indicates

surplus.

The fiscal indicators such as fiscal deficit,

revenue deficit and liabilities showing the fiscal outcomes for

previous year, current year, ensuing budget year and two outward

years are presented in the Form F-1 following the stipulations of the

Sikkim FRBM Act (Table 10). The fiscal indicators show that there has

been an improvement in fiscal situation and the State Government

achieved the targets of the fiscal path chalked out by the Thirteenth

Finance Commission (TFC) starting from the year 2012-13. After the

enactment of the FRBM Act of Sikkim in 2010, this is the third MTFP

document that contains fiscal projections for the period 2013-14 (BE)

to 2015-16. The MTFP builds on the fiscal consolidation process of

the State Government and the fiscal outlook for the budget year and

the two outward years comply with the TFC fiscal path. It needs to be

mentioned here that the fiscal path chalked out by the TFC ends at

2014-15, whereas the MTFP goes beyond this target year. However the

MTFP assumes that the fiscal management in the State will continue to

be prudent and remain sustainable even after the TFC targets. The

Fourteenth Finance Commission, which has already been constituted,

will provide guidelines and principles for fiscal management for the

State Government starting from the year 2015-16. The Government

of Sikkim is committed to adhere to the fiscal path to be suggested

by the Fourteenth Finance Commission also.

Table 11

Medium Term Fiscal Plan: 2012-13 to 2014-15

(AS Percent to GSDP)

|

|

2011-12

|

2012-13

|

2013-14

|

2014-15

|

2015-16

|

|

Revenue Receipts

|

34.19

|

43.49

|

40.98

|

43.52

|

46.25

|

|

Own Tax Revenues

|

3.50

|

3.96

|

4.09

|

4.14

|

4.19

|

|

Income Tax

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

|

Sales Tax

|

1.48

|

2.18

|

2.16

|

2.21

|

2.25

|

|

State Excise Duties

|

1.15

|

1.02

|

1.05

|

1.02

|

1.00

|

|

Motor Vehicle Tax

|

0.20

|

0.16

|

0.16

|

0.16

|

0.16

|

|

Stamp Duty and Registration Fees

|

0.10

|

0.08

|

0.08

|

0.07

|

0.07

|

|

Other Taxes

|

0.58

|

0.52

|

0.64

|

0.68

|

0.71

|

|

Own Non-Tax Revenues

|

2.91

|

3.16

|

3.06

|

3.08

|

3.11

|

|

Central Transfers

|

27.79

|

36.37

|

33.82

|

36.29

|

38.95

|

|

Tax Share

|

7.28

|

7.47

|

8.00

|

8.63

|

9.31

|

|

Grants

|

20.51

|

28.90

|

25.82

|

27.66

|

29.64

|

|

Revenue Expenditure

|

28.92

|

30.64

|

31.24

|

33.02

|

34.90

|

|

General Services

|

8.96

|

9.96

|

10.40

|

11.02

|

11.69

|

|

Interest Payment

|

2.27

|

2.15

|

1.99

|

2.11

|

2.11

|

|

Pension

|

2.07

|

2.56

|

2.73

|

3.18

|

3.70

|

|

Other General Services

|

4.62

|

5.24

|

5.68

|

5.74

|

5.88

|

|

Social Services

|

12.28

|

11.43

|

12.15

|

12.96

|

13.82

|

|

Education

|

5.65

|

5.70

|

5.96

|

6.31

|

6.69

|

|

Medical and Public Health

|

1.36

|

1.35

|

1.30

|

1.34

|

1.39

|

|

Other Social Services

|

5.28

|

4.38

|

4.89

|

5.31

|

5.75

|

|

Economic Services

|

7.31

|

8.72

|

8.16

|

8.51

|

8.87

|

|

Compensation and Assignment to LBs

|

0.37

|

0.53

|

0.53

|

0.53

|

0.53

|

|

Capital Expenditure

|

7.92

|

16.09

|

12.74

|

13.50

|

14.34

|

|

Capital Outlay

|

7.33

|

16.04

|

12.65

|

13.42

|

14.27

|

|

Net Lending

|

0.59

|

0.05

|

0.09

|

0.08

|

0.07

|

|

Revenue Deficit

|

-5.27

|

-12.85

|

-9.74

|

-10.50

|

-11.34

|

|

Fiscal Deficit

|

2.14

|

3.24

|

3.00

|

3.00

|

3.00

|

|

Primary Deficit

|

-0.13

|

1.08

|

1.01

|

0.89

|

0.89

|

|

Outstanding Debt

|

30.39

|

29.92

|

29.90

|

29.87

|

29.85

|

Notes: 1.

GSDP is the Gross Domestic Product at

current prices as per revised series of 2004-05 base

2.

The negative sign in revenue deficit

indicates surplus.

The detailed projection of fiscal variables

presented in Table 11 shows that the revenue account surplus has been

growing during the MTFP period and the fiscal deficit has been

stabilized at 3 per cent relative to the GSDP. Starting with

the budget year, the capital expenditure has grown in the last two

years of the MTFP. The capital expenditure could be raised due to

significant revenue surplus without adversely affecting the fiscal

deficit. Investments in physical and social infrastructure have

received larger attention in the State for which capital expenditure

has grown steadily. The focus on investments in infrastructure will

remain a key factor in fiscal policy of the Government with the State

economy growing in future years. Higher growth of the economy which

would further improve the revenue situation coupled with prudent

expenditure management is expected to improve the capital

expenditure.

4.2 Assumption Underlying the Fiscal

Indicators

According to the TFC roadmap for fiscal

consolidation, Sikkim was expected to achieve 3.5 per cent fiscal

deficit relative to GSDP by 2011-12 and reach at 3 per cent level by

2013-14. Despite the natural calamities and disruption in

business activities affecting revenues the State managed to adhere to

the TFC fiscal targets as stipulated in the FRBM Act of Sikkim. The

MTFP assumes to continue with the fiscal consolidation process and

structure the expenditures in the priority areas to help the

development process in the State.

The MTFP uses the GSDP growth rate prescribed

by the TFC on a year on year basis for the period from 2013-14 to

2014-15 for Sikkim (see Box 1). For the year 2015-16, which is beyond

the TFC award period, the MTFP uses the same growth rate as that of

the year 2014-15. For the purpose of MTFP, instead of taking

aggregate own revenue, prescriptive buoyancy based growth rates of

individual taxes are used for projection purpose. The buoyancy

coefficients for the period 2004-05 to 2013-14 indicate that the

growth rate of the State taxes is below the growth rate of the GSDP.

The prescriptive buoyancies for individual taxes like sales tax,

excise duty, motor vehicle tax, stamps and registration duties have

been increased keeping in mind the scope for improvement in these

taxes. For other taxes, the observed buoyancy for the period between

2004-05 and 2013-14 was taken as prescriptive buoyancies. The 2013-14

budget projected higher sales tax collection target of Rs.225 crores

as against actual figures of Rs.124.19 croers in 2011-12.. The higher

tax collection target was based on the Government’s attempt to

streamline the tax administration and expansion of tax base. The

Government has initiated major e-governance programmes in the tax

departments to introduce online registration, e-filling of returns

and electronic control and evaluation majors.

The MTFP proposes to keep the trend growth rate

of non-tax revenues for the period from 2004-05 to 2013-14 (BE) for

the purpose of projection. In the case of central transfers also, the

recommended State specific grants by the TFC are factored in during

the projection year. For the share in central taxes budgetary figure

for the year 2013-14 is allowed to grow at a rate marginally lower

than the observed rate of trend growth rate during 2004-05 to 2013-14

(BE).

Expenditure Restructuring under MTFP

The revenue expenditure has been stabilized at

around 30 per cent relative to GSDP since 2009-10. The profile of

expenditure in the State reveals that due to higher emphasis on

priority sector spending the revenue expenditure as percentage to

GSDP has increased in RE 2012-13 and BE 2013-14. The MTFP proposes to

continue with this fiscal management approach and provide higher

level of sources to priority sectors. The MTFP, while restructuring

the expenditure, keeps in consideration the fiscal targets to be

achieved by the State in the medium term. Thus

attempt was not made to compress the revenue expenditure to achieve

the fiscal targets. In the medium term efforts have been made to

improve the revenue surplus through higher revenue generation and

provide for the spending in the development sector. The encouraging

trend that comes out of the expenditure structure is the rise in

share of social and economic services in resource allocation.

The ensuing budget contains policy

announcements regarding new schemes in various sectors. The

Government initiated several new schemes to improve social and

economic infrastructure last year. The resource allocation in the

MTFP has taken into consideration all the existing programmes and new

schemes proposed in the 2013-14 budget announcements. The existing

and new schemes in various sectors like agriculture and rural

development, health, education, tourism, and other infrastructure

sectors underline the focus areas for the Government in the medium

term. Based upon the announced policies of the State Government, the

MTFP proposes to strengthen social and economic sector expenditure

further by making adequate provisions. The social sector expenditure

as per cent of GSDP increases from 12.15 per cent in BE 2013-15 to

13.82 per cent in 2015-16. Similarly the expenditure under economic

services has increased from 8.16 to 8.87 per cent during this period.

The general services also experience a rise.

The revenue expenditure, taking into account

allocations to different sectors based on Government priorities

during the MTFP period, rises from 31.24 per cent to GSDP in BE

2013-14 to 34.90 per cent in 2015-16 (Table 11). The rise in revenue

expenditure during the projection period is not very sharp and the

MTFP takes a balanced view between keeping the focus on social and

economic sectors intact and remain in the fiscal consolidation. The

rise in revenue expenditure does not reduce the revenue surplus,

which is used for higher capital expenditure and stabilize the fiscal

deficit..

The capital expenditure at 12.74 per cent to

GSDP in 2013-14 (BE) has been higher than that for the year 2011-12

at 7.92 per cent. As the fiscal deficit is stabilized at 3 per cent

to GSDP and revenue account surplus has been growing in the medium

term, the capital expenditure is allowed to grow during the MTFP

period. The capital expenditure increased from 12.74 per cent to GSDP

in 2013-14 (BE) to 14.34 per cent in 2015-16. The capital expenditure

is raised during the MTFP period aligned with the fiscal targets. The

MTFP keeps the requirements of infrastructural development in the

State and immediate need for rebuilding of the earthquake affected

infrastructure while projecting the capital expenditure.

Debt and Deficit under MTFP

The revenue surplus profile, which indicates a

rising trend during the MTFP period, is given in Table 11. The rise

in revenues that includes central transfers and controlled increase

in revenue expenditure resulted in higher revenue surplus. The fiscal

deficit has been estimated to remain at 3 per cent level starting

with the 2013-14 (BE). The fiscal deficit target complies with the

fiscal adjustment prescribed by the TFC for Sikkim. The emerged

fiscal profile shows that the outstanding debt is also stabilized

below 30 per cent relative to GSDP.. This debt-GSDP ratio path

remains lower than that of the debt path for Sikkim proposed by the

TFC. The TFC has assumed a debt-GSDP ratio of 58.80 per cent in

2013-14, and 55.90 per cent in 2014-15 (see Report of TFC,

Annex 9.1, pp 409). It needs to be emphasized here that the State

Government is committed to strengthen the fiscal consolidation

process and achieve the objectives of the FRBM Act.

Box 1

Proposed MTFP Targets

|

Macro Parameters

·

Nominal Growth of GSDP as prescribed by

the TFC, 11.25 per cent

Revenue Resources

·

Sales tax assumes a buoyancy of 1.2 as

against the observed buoyancy of 0.687

·

The state excise duty assumes a buoyancy

of 0.750.

·

The stamp duty and registration fees

assumes a buoyancy of 0.800

·

Motor Vehicle tax assumes a buoyancy of

1.00

·

Other taxes assumes a buoyancy of 1.501

Expenditure Projections

·

Pension payments are projected on the

basis of the historical growth rates for pension payments for the

period from 2004-05 to 2013-14 (BE). The observed growth of

pension during this period was 30 per cent.

·

The interest payments have been

estimated on the basis of the effective rate of interest

calculated on the base year (2011-12) value of interest payment

divided by the stock of debt of the previous year.

·

The growth rates in the area of high

priority development expenditure in social services and within

that, in health and education, are assumed to continue during the

MTFP period.

·

Social services expenditures will grow

at the rate of 18.66 per cent per annum.

·

Education expenditure will grow at the

rate of 17.86 per cent per annum

·

Health expenditure will grow at the rate

of 15.00 per cent per annum.

·

Capital expenditure to GSDP ratio is

expected to increase from 12.74 per cent in 2013-14 (BE) to 14.34

per cent in 2015-16 with a growth rate of 17 per cent.

Deficit and Debt targets

·

The MTFP 2013-14 to 2015-16 projects the

revenue surplus to increase from 9.74 per cent to the GSDP to

11.34 per cent.

·

The fiscal deficit is projected to

remain at 3 per cent level relative to the GSDP

·

The outstanding debt to GSDP ratio is

expected to decline from 29.90 per cent to 29.85 per cent.

|

5. Conclusion

The MTFP covering the period from 2013-14 (BE) to 2015-16 has been

prepared on a backdrop of an improved fiscal situation in the State.

The fiscal performance indicators for the year 2011-12, the last year

for which the actual data is available, reflect this situation. The

State Government has initiated several schemes in the social and

economic sectors in recent years. The MTFP has been prepared with

objective of safeguarding the fiscal consolidation process and

provide adequate resources to existing schemes in priority areas.

Thus the medium term framework is based on detailed analysis of the

state finances and the revenue and expenditure policies announced in

recent years and in the budget of 2013-14. The revenue augmentation

measures, expenditure side restructuring based on the priorities

expressed in the budget, and the resultant borrowing requirements are

elaborated in the MTFP. In the revenue side, the need for improving

revenue receipts is reflected in the changes in tax policies and tax

administration measures. The MTFP makes projections for two outward

years beyond the BE 2013-14 keeping the requirement of achieving

fiscal prudence to continue on the proposed fiscal roadmap of the

TFC. The MTFP proposes to maintain the 3 per cent fiscal deficit

relative to GSDP and generate increasing level of surplus in the

revenue account. The favourable fiscal situation made it possible to

increase the capital expenditure during the MTFP period. As the

growth prospective for the state looks bright in the coming years,

the State will be able to increase the capital expenditure. The debt

burden of the State is already below the limits suggested by the TFC.

With the decline in debt servicing obligation for the state based on

realistic assumption with regard to the average cost of debt and the

level of fiscal deficit, the debt burden is further projected to

decline. To conclude, the Government of Sikkim is committed to

maintain the fiscal discipline and stability in the State and manage

the fiscal policy to strengthen the growth process.

Disclosures

Form D-1

(See Rule 4)

Select Fiscal Indicators

|

Sl. No.

|

Item

|

Previous Year

2011-12 (Actuals)

|

Current Year

2012-13(RE)

|

|

1

|

Gross Fiscal Deficit as Percentage to GSDP

|

2.14

|

3.24

|

|

2

|

Revenue Deficit as Percentage of GSDP

|

-5.27

|

-12.85

|

|

3

|

Revenue Deficit as Percentage of Gross Fiscal

Deficit

|

-245.61

|

-396.83

|

|

4

|

Revenue deficit as Percentage of TRR

|

-15.41

|

-29.55

|

|

5

|

Debt Stock as Percentage of GSDP

|

28.94

|

28.81

|

|

6

|

Total Liabilities as Percentage to GSDP

|

30.39

|

29.92

|

|

7

|

Capital Outlay as Percentage of Gross Fiscal

Deficit

|

341.78

|

495.31

|

|

8

|

Interest Payment as Percentage of TRR

|

6.64

|

4.95

|

|

9

|

Salary Expenditure as Percentage of TRR

|

37.29

|

29.00

|

|

10

|

Pension Exp. As Percentage of TRR

|

6.05

|

5.90

|

|

11

|

Non-development Expenditure as Percentage of

Aggregate Disbursements

|

25.54

|

25.67

|

|

12

|

Non-tax Revenue as Percentage of TRR

|

8.50

|

7.26

|

Form D-2

(See Rule 4)

Components of State Government Liabilities

Rs. Crore

|

Category

|

Raised during the fiscal year

|

Repayment during the fiscal year

|

Outstanding Amount

(End March)

|

|

Previous Year (Actuals)

|

Current year

(RE)

|

Previous Year (Actuals)

|

Current year

(RE)

|

Previous Year (Actuals)

|

Current year

(RE)

|

|

Internal Debt

|

86.89

|

232.26

|

45.30

|

62.30

|

1695.26

|

1865.22

|

|

Loan from Centre

|

0.55

|

14.50

|

3.36

|

10.45

|

157.00

|

161.05

|

|

State Provident Funds

|

195.35

|

209.50

|

126.83

|

122.35

|

578.80

|

665.95

|

|

Reserve Funds/Deposits

|

410.45

|

127.33

|

394.77

|

145.11

|

121.76

|

103.98

|

|

Other Liabilities

|

|

|

|

|

|

|

Form D-3

(See Rule 4)

Guarantees Given by the Government (Rs. Crore)

|

Sl.No

|

Name of the Institution to which Guarantees is

given

|

Maximum Guarantee given

|

Remarks.

|

|

1

|

Sikkim Industrial Development &

Investment Corporation Ltd.

|

285.00

|

|

|

2

|

Scheduled Castes Scheduled Tribes and Other

Backward Classes Development Corporation Ltd. (SABCO)

|

25.00

|

|

|

|

Total

|

310.00

|

|

|

|

|

|

|

Form D-4

(See Rule 4)

Number of Employees in Public Sector Undertakings &

Aided Institutions and Expenditure of State Government

|

Sl.No

|

Sector Name

|

Total Employees as on 31.3.2013

|

Related Expenditure

Rs. Crore

|

|

|

|

|

On Salary

|

On Pension

|

|

A( a)

|

Regular government Employees

|

30903

|

1178.91

|

239.66

|

|

( b)

|

Work Charged

|

1636

|

|

|

|

( c)

|

Muster Roll

|

10801

|

|

|

|

(d)

|

Others

|

10739

|

|

|

|

|

|

|

|

|

|

B

|

Public Sector Undertakings & Aided

Institutions

|

|

|

|

|

1

|

State Bank of Sikkim

|

314

|

11.05

|

|

|

2

|

Govt. Fruit Preservation Factory

|

87

|

1.02

|

|

|

3

|

Sikkim Hatcheries Pvt. Ltd

|

10

|

0.06

|

|

|

4

|

Sikkim Poultry Dev corp.

|

5

|

0.04

|

|

|

5

|

Sikkim Handloom

and Handicraft Dev. Corp.

|

9

|

0.41

|

|

|

6

|

Denzong Agricultural Co operative Society.

|

40

|

0.47

|

0.009

|

|

7

|

Sikkim State Co- Operative Bank Ltd.

|

60

|

2.11

|

0.22

|

|

8

|

Sikkim Co- Operative Milk Producers' Ltd.

|

133

|

1.73

|

0.10

|

|

9

|

Sikkim Schedule Caste & Schedule Tribe

and Other Backward Classes Dev. Co operation Ltd. (SABCO)

|

23

|

0.95

|

|

|

10

|

State Trading Corporation of Sikkim.

|

63

|

2.42

|

0.12

|

|

11

|

Sikkim Industrial

Dev and Investment Corporation Ltd.

|

43

|

1.81

|

|

|

12

|

Sikkim Tourism Dev. Corporation Ltd.

|

87

|

1.10

|

0.05

|

|

13

|

Sikkim State Co-Operative Supply &

Marketing Federation Ltd.

|

88

|

2.42

|

0.026

|

|

14

|

Sikkim Power Dev.

Corporation .

|

66

|

0.92

|

|

|

15

|

Sikkim Consumers' Co operative Society Ltd.

|

26

|

0..37

|

|

|

16

|

Sikkim Livestock

Processing & Development Corporation Ltd

|

2

|

0.03

|

|

Source of information of Sl.A is from DESM&E.The

total employee under A(d) is inclusive of B.